The Underwriting Department

We know underwriting is critical to your practice. That is why we have spent decades ensuring you have a team of experts by your side. From helping you understand the backend process, keeping you up to date with system changes, and monitoring your pending cases for streamlined approvals. We encourage all our producers to get to know our underwriting team as they supplement your success.

Denise Rachalski | Underwriting Manager

Jessica Rios | Administrative Assistant

Paulette Anders | Policy Owner Services & Receptionist

(239) 561-2900

Success is a process, let us guide you.

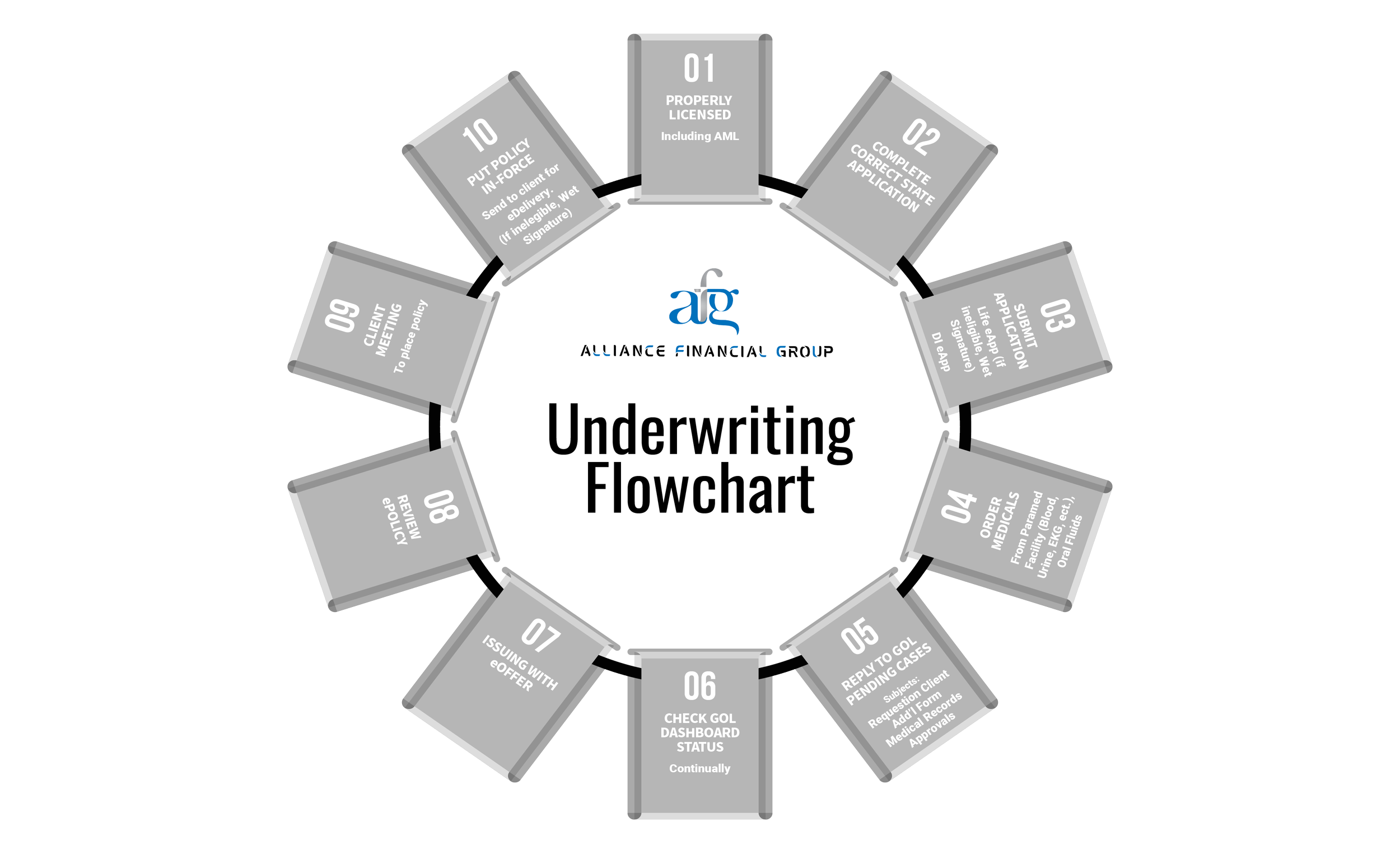

For an automatic start, go to Guardian Online. Otherwise, use our simplified 6 step process to get your policies paid.

Step 1 | Getting Started

Product

Overview

Learn everything you need to know about the product your client needs.

Illustrations Are

Everything

Your client’s E-Signable illustration generated from the Guardian Proposal System.

Underwriting

Advantage Programs

Guardian is driven to provide the best rates for your clients in competitive markets.

For DI - Select “Special Programs” to discover coverage options.

eApp/eMed

Applications

Use this guide to assist completing a Life or DI eApp.

Step 2 | Underwriting Requirements

Your Client Underwriting Quick Guide.

Rating Classification Criteria

Financial Underwriting Income Replacement

Build Table

Step 3 | Medical Guidelines

The

Requirements

Guardian Underwriting Team strives to issue business expeditiously.

Stand Alone

eMed

Get an edge on underwriting and save time for you and your clients.

ParaMed, Physical, Labs & Oral Fluids

Explore Guardian’s approved vendor list to begin your medical underwriting.

Attending Physician Statement

Certain medical conditions will require medical records (APS).

Step 4 | Underwriting Communication

Life & Disability GOL Dashboard Messaging

Throughout your underwriting process, you must communicate and track your applications through the GOL Dashboard Messaging Platform until the policy is approved.

iPipeline

Obtain your requested underwriting forms directly on your GOL iPipeline. (Client & Prospecting Activity Column > iPipeline)

IM eSignature

Provide your client with an efficient and convenient option for additional requested forms. Learn how to access and send documents through IM eSignature.

Step 5 | Issuing The Policy

eOffer - Life/DI

What you’ve been waiting for.

GPS Life Illustration

It’s time to submit the correct illustration for Life policy issuing. Details mean everything.

Policy Link

You’re almost there! Expect an email with your policy link.

Step 6 | ePolicy Delivery

Congratulations - The Policy Is Ready To Be Paid.

Electronically sign, pay, and save your new policy - when and where it’s convenient for you.